Treasurer Josh Frydenberg announced the 2021 federal budget last night, with the clear focus on stimulating our economy through giving additional support to businesses as well as individual taxpayers. With Australia now technically in a recession, our first since the early 90’s, the budget was aimed to provide a roadmap to recovery from the COVID 19 pandemic for the 2021 financial year and beyond.

Here are a few key points of what was announced last night:

TAX CUTS FOR LOW TO MEDIUM INCOME EARNERS

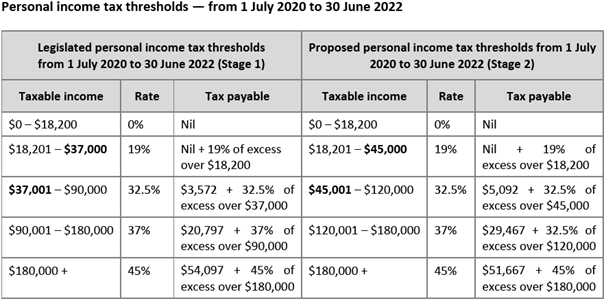

The government is bringing forward the tax cuts originally planned for 2023 financial year, with the budget proposing that these now take effect from 1 July 2020 (i.e. the 2021 financial year).

- The 19 percent tax bracket has been expanded to include incomes up to $45,000($37,000 previously).

- The 32.5 percent tax bracket has been expanded to include incomes up to $120,000 ($90,000 previously).

- The low income tax offset will be increased from $445 to $700, with taxpayers on incomes of $37,000 or less being able to take full advantage of this.

These changes are better illustrated by the table below:

JOBMAKER CREDIT FOR BUSINESSES HIRING NEW EMPLOYEES

To encourage businesses to hire new employees, they will receive assistance in the form of a weekly cashback per new employee they take on board.

Details are as follows:

- To take effect from the 7th of October 2020 and will run through to 6 October 2021.

- Businesses will receive a payment of $200 per week over 12 months (up to $10,400 per new job) for a new employee aged 16 to 29 years.

- Businesses will receive a payment of $100 per week over 12 months for a new employee aged 30 to 35 years.

For the employer to be eligible they will need to ensure the following:

- The new employee has worked a minimum of 20 hours per week (averaged over a quarter).

- The new employee must have received the Jobseeker payment, Youth Allowance or Parenting Payment for at least one month out of the three months prior to when they were hired.

- The employer’s headcount must have increased from the reference date of 30 September 2020, so it must be a genuine new job that has been created.

- The employer’s total payroll must also have increased when compared to the three months to 30 September 2020.

- The employer must be up to date with all tax lodgement obligations.

Registrations will open for eligible employers through ATO online services from 7 December 2020.

INSTANT ASSET WRITEOFF – NOW GREATLY EXPANDED

Businesses with an aggregated turnover of under $5 billion (so, safe to say, nearly all businesses) will be able to claim an immediate tax deduction for the full cost of eligible capital assets (no cost limit) acquired from 7:30pm AEDT on the 6th of October, that are first installed and ready for use by 30 June 2022.

Eligible capital assets include new depreciable assets and certain improvements to existing assets. For businesses with an aggregated turnover of less than $50 million, this will also include second hand assets.

It is therefore quite possible that businesses can push themselves into a tax loss position for the 2021 and 2022 financial years, depending on the cost of new assets purchased. If the business is run out of a company, this plays into the next point to be discussed, which covers using these tax losses against the tax paid on prior returns lodged.

COMPANY TAX LOSSES – NOW CAN BE USED TO OFFSET EARLIER TAX PROFITS

Under current law, tax losses can only be applied to current or future tax profits. However, the proposed (temporary) changes will now allow you to apply these losses to previously lodged tax returns that had taxable profits.

Eligible companies will be able to elect to carry back tax losses made during the 2020, 2021 or 22 financial years to offset previously taxed profits in the 2019 financial year or later.

For example, if your company had a tax loss in the 2020 financial year due to the pandemic, but had a taxable profit in the 2019 financial year, you will now be able to elect to apply the tax loss you made in 2020 to reduce the profit you made in 2019. This will result in a tax refund to your company, depending on the amount of the loss made in the 2020 financial year. You will not be required to amend the company’s 2019 income tax return to claim the tax loss.

That’s all for now!

No doubt, much more detail on the budget and everything discussed above will eventually surface in the coming weeks. It will take some time for the proposed changes to become law and receive hard legislation, but if you have any queries in the meantime, please do not hesitate to contact your usual HMH advisor.